Entrepreneurs – Having Trouble Raising Capital? One Reason Why

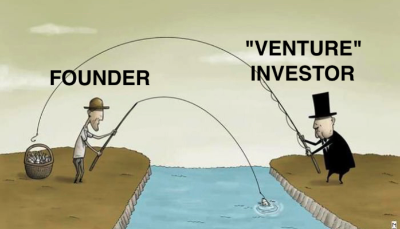

One of the ongoing challenges many founders will face at some point is the dreaded capital raise beyond friends and family. I have not met many entrepreneurs’ who actually enjoy the idea of going out to the market and asking for money. This year has been a typical year for us evaluating over 100 capital raise deals and most will never get funded for one specific reason – the PASSION is not directed to what matters most – EXECUTION.

“Bootstrapping a business when you’re not drawing a salary and depleting whatever savings you have is one of the most difficult things to do,” says Toby Stuart, professor at the Haas School of Business at the University of California, Berkeley. Remember hiring great people along with not running out of money go hand in hand!

The typical entrepreneur is an optimist and illustrates great passion for their unique product or service, which is imperative to get the idea off the ground. This enthusiasm is directed to emotional conversations of increases sales, earnings, product innovation and scaling to the moon.

However, the passion will only go so far in an investor pitch. Bill Sahlman, from Harvard Business School states it best, “ It’s never the idea; it’s always the execution.”

This year has been exceptionally busy evaluating numerous potential capital raise opportunities during our due diligence phase. Looking at the successfully fully funded companies we have reviewed over the last 5 years, (most founders we see for the first time are forecast significantly lower amounts of funding than is actually needed) the overriding success theme in the pitch was beyond just the idea and about full execution.

SUCCESS TIP FOR YOUR PITCH: When pitching to family offices or investment groups, if you want to increase your opportunities, continue to be persistent and remaining enthusiastic, but you must appeal emotionally and not always intellectually to these potential investors. Every company can be overanalyzed to why it won’t work and the key is to drive home your passion around actual execution strategies.

If you want to know the best “Pitch” questions to be prepared for, email me at wayne.kurtz@greentrailinvestments.com and I will send them over to you.